Ways to Donate

Thank you for giving! With your support, Isabel’s House provides 24/7/365 safe refuge for children.

Donor Contributions + Grant Funding + Contract with State of Missouri =

over 3,000 nights of care each year!

Isabel’s House (Crisis Nursery of the Ozarks, Inc.) is a registered 501(c)(3) non profit organization. Your contribution may be tax deductible. Please consult with your personal tax advisor about your charitable giving.

Donor Contributions + Grant Funding + Contract with State of Missouri =

over 3,000 nights of care each year!

Isabel’s House (Crisis Nursery of the Ozarks, Inc.) is a registered 501(c)(3) non profit organization. Your contribution may be tax deductible. Please consult with your personal tax advisor about your charitable giving.

Donations in the form of checks or money orders may be mailed or delivered to:

Isabel’s House

2750 West Bennett

Springfield, MO 65802

Credit or Debit Card donations may be made online via our secure donation page.

Cash and In-Kind Donations may be made in-person at Isabel’s House.

Isabel’s House

2750 West Bennett

Springfield, MO 65802

Credit or Debit Card donations may be made online via our secure donation page.

Cash and In-Kind Donations may be made in-person at Isabel’s House.

Did you know?

The average cost of one 24-hour stay at Isabel’s House for one child is around $480? This includes

a medical exam & any necessary follow up treatments, three meals and snacks, hygiene items,

therapeutic & enrichment activities, transportation to & from school, a set of new clothing & shoes, & a toy or blanket to take home.

Isabel’s House relies on the regular, sustaining gifts made by members of our Monthly Giving Program: Hope365.

To give a monthly gift, simply authorize Isabel’s House to make a regular ACH withdrawal from your Checking or Savings account or a regular charge to your Credit or Debit Card. A summary of your annual contribution will be provided for your tax preparation.

Contact us or start your monthly gift online today!

The average cost of one 24-hour stay at Isabel’s House for one child is around $480? This includes

a medical exam & any necessary follow up treatments, three meals and snacks, hygiene items,

therapeutic & enrichment activities, transportation to & from school, a set of new clothing & shoes, & a toy or blanket to take home.

Isabel’s House relies on the regular, sustaining gifts made by members of our Monthly Giving Program: Hope365.

To give a monthly gift, simply authorize Isabel’s House to make a regular ACH withdrawal from your Checking or Savings account or a regular charge to your Credit or Debit Card. A summary of your annual contribution will be provided for your tax preparation.

Contact us or start your monthly gift online today!

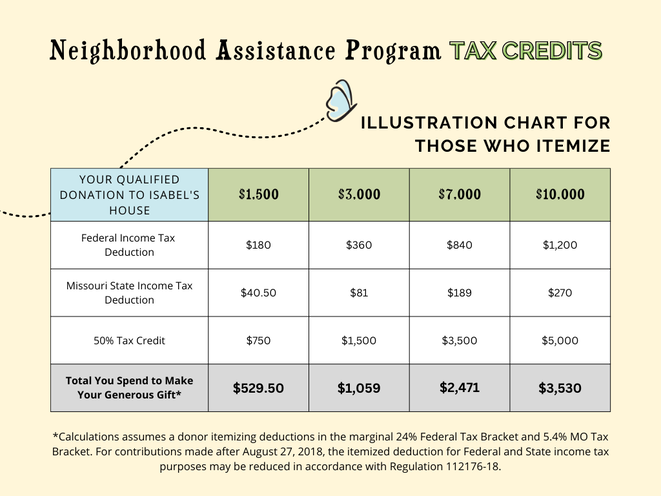

Eligible donors of $100 or more residing in the state of Missouri may apply for the Champion for Children (CFC) Tax Credit program (download illustration). CFC allows qualifying individuals and businesses to apply for up to a 50% credit for a contribution made to Isabel’s House. Click here for complete program details and limitations.

The Neighborhood Assistance Program (NAP) Tax Credit allows qualified businesses and individuals receiving certain types of business income (see eligibility requirements) to apply for up to a 50% credit for a contribution made to Isabel’s House. This credit requires more detailed documentation, and your application must be initiated through Isabel’s House.

To check available Tax Credits for gifts to Isabel’s House, please contact our Director of Development, Fatima, at (417) 865-2273 ext. 104.

The Neighborhood Assistance Program (NAP) Tax Credit allows qualified businesses and individuals receiving certain types of business income (see eligibility requirements) to apply for up to a 50% credit for a contribution made to Isabel’s House. This credit requires more detailed documentation, and your application must be initiated through Isabel’s House.

To check available Tax Credits for gifts to Isabel’s House, please contact our Director of Development, Fatima, at (417) 865-2273 ext. 104.

Isabel’s House is honored to be a Children’s Trust Fund grant recipient. Isabel’s House directly benefits from your participation in the CTF “License to Care” specialty license plate program!

Follow this link to learn more about making your $25 or more annual donation to CTF and designating Isabel’s House as your local partner, and join hundreds of fellow Isabel’s House supporters in displaying the CTF specialty plate and becoming a daily, public advocate for the prevention of child abuse and neglect!

Follow this link to learn more about making your $25 or more annual donation to CTF and designating Isabel’s House as your local partner, and join hundreds of fellow Isabel’s House supporters in displaying the CTF specialty plate and becoming a daily, public advocate for the prevention of child abuse and neglect!

Making a special, one-time gift or an annual gift of appreciated securities (stocks, bonds, ETFs, etc.) is a great way to maximize your tax deductions, avoid capital gains taxes, and make a significant gift to Isabel’s House all at the same time. Donations of securities can also, in most cases, qualify you for the Tax Credit programs outlined above.

From time to time, Isabel’s House may also accept personal property and real estate if it supports the mission of Isabel’s House and meets certain criteria set forth by the Board of Directors.

To discuss the process for making gifts of securities or property, please contact our Director of Development, Fatima, at (417) 865-2273 ext. 104 or email [email protected]

From time to time, Isabel’s House may also accept personal property and real estate if it supports the mission of Isabel’s House and meets certain criteria set forth by the Board of Directors.

To discuss the process for making gifts of securities or property, please contact our Director of Development, Fatima, at (417) 865-2273 ext. 104 or email [email protected]

Planned gifts made to our Endowment allow you to continue giving the gift of hope to area families. Your action today to endow our programs or to include Isabel’s House as part of your estate planning makes you a “Pillar of Hope” for parents working to build a bright future for their children.

Planned gifts to Isabel’s House can be simple, straightforward changes to an estate plan, such as naming Isabel’s House in your will or a trust, or naming Isabel’s House as a percentage beneficiary in your retirement plan or a life insurance policy. Some planned gifts require more steps, but have added benefits of security right now for you and your family. These may include:

Charitable Gift Annuities – transferring assets to Isabel’s House in exchange for a fixed income to yourself.

Charitable Remainder Trusts – Transferring assets to a trustee to provide income to you for life, with the remainder balance coming to Isabel’s House upon your death.

Charitable Lead Trusts – Transferring assets to a trustee to provide income to Isabel’s House for a fixed period of time, then reverting back to you or other beneficiaries.

If your plan results in an irrevocable transfer, a partial tax deduction is usually possible for your heirs.

Planned gifts to Isabel’s House can be simple, straightforward changes to an estate plan, such as naming Isabel’s House in your will or a trust, or naming Isabel’s House as a percentage beneficiary in your retirement plan or a life insurance policy. Some planned gifts require more steps, but have added benefits of security right now for you and your family. These may include:

Charitable Gift Annuities – transferring assets to Isabel’s House in exchange for a fixed income to yourself.

Charitable Remainder Trusts – Transferring assets to a trustee to provide income to you for life, with the remainder balance coming to Isabel’s House upon your death.

Charitable Lead Trusts – Transferring assets to a trustee to provide income to Isabel’s House for a fixed period of time, then reverting back to you or other beneficiaries.

If your plan results in an irrevocable transfer, a partial tax deduction is usually possible for your heirs.

Isabel’s House recognizes the contribution of donors who provide lifelong support for our mission.

Please contact Shayla Yardley, Executive Director, at (417) 865-2273 x100 to discuss a planned gift to Isabel’s House.

Please contact Shayla Yardley, Executive Director, at (417) 865-2273 x100 to discuss a planned gift to Isabel’s House.